TAKE ON THE MARKETS WITH GUARDIAN

Optimized services, tools and support designed specifically for active traders.

Why Do Active Traders Use Guardian?

Pricing. Routing. Service.

Guardian Trading’s mission is simple; to provide active traders with high-performance tools, comprehensive services, competitive pricing, and proactive client support to maximize their trading performance and profitability.

With services prioritizing speed, control, and cost efficiency, we provide the resources to help traders realize their full potential.

Control Your Costs With Customized Commissions

Options Contracts

AS LOW AS:

$0.15

PER CONTRACT*

Equities Commissions

AS LOW AS:

$0.0005

PER SHARE

*Options commission does not include standard pass-through fees such as the Options Reporting Fee, Options Clearing Corporation or exchange fees on index contracts, etc.*

Master Your Order Flow

SPEED AND TIMING ARE EVERYTHING IN TRADE.

- Execute orders quickly

- In-house stock borrow desk for locates and overnight borrows

- 30+ Order routing options including ALGO and dark pool routes

- ECN Rebates

- Access to Liquidity

- Connect your trading via an API

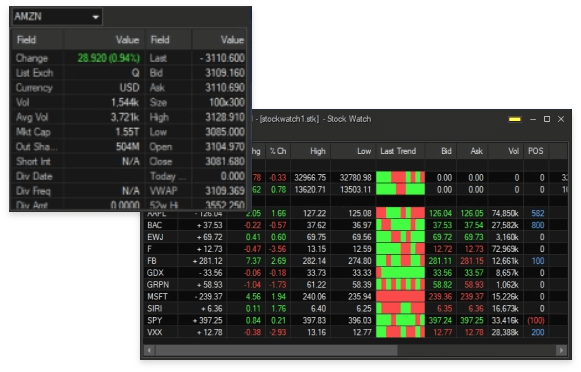

Locates & Stock Borrows

With a speedy and efficient locate product, traders can obtain locates, if required, for short sales seamlessly.

- Easily place compliant short trades

- Reduce costs with a robust easy-to-borrow securities list

- Leverage our in-house borrows & locates team

Trading Technology

Our OMS Platforms

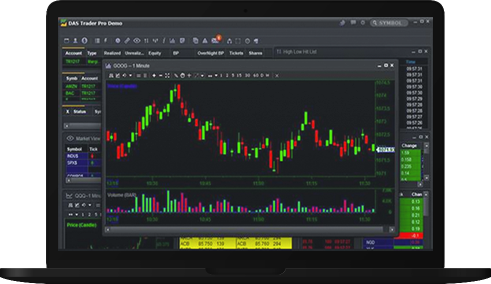

DAS TRADER PRO

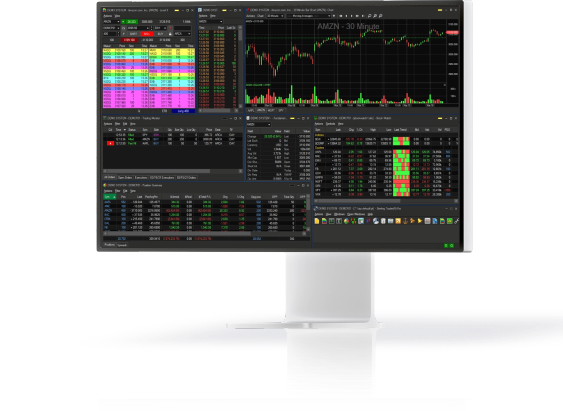

STERLING TRADER® PRO

Enjoy real-time trading with advanced order types, multi-account management, and analytical tools designed for the active trader. Try a paper trading account free for 14 Days with a simulated portfolio and test the power of these features for yourself!

Our Infrastructure

SPEED. EFFICIENCY. ACCESS.

Our proprietary stock locate system, high-tech clearing, low-latency execution platforms, and competitive securities lending services work together to provide everything traders need under one roof.

Experience the Guardian Difference

Open an account and become a Guardian Trader today.